E-Mail: info(at)go-eu.com

Tel: +49 (0)89 904 22 360

Update 2023: 10 minutes initial consultation at 100% free of charge.

Inquire now

Rufen Sie uns an: +49 89 904 22 360

Taxes and duties in Romania

01 November 2022 8381 6Below we cover all types of tax in Romania and note what will change in 2023 and which tax rates will apply. Before we start and examine all Romanian taxes, we would like to address the differences in tax revenues within the EU. The differences within the countries are significant.

We clarify:

How much taxes do you pay in Romania?

(DE vs. RO) - how much is left?

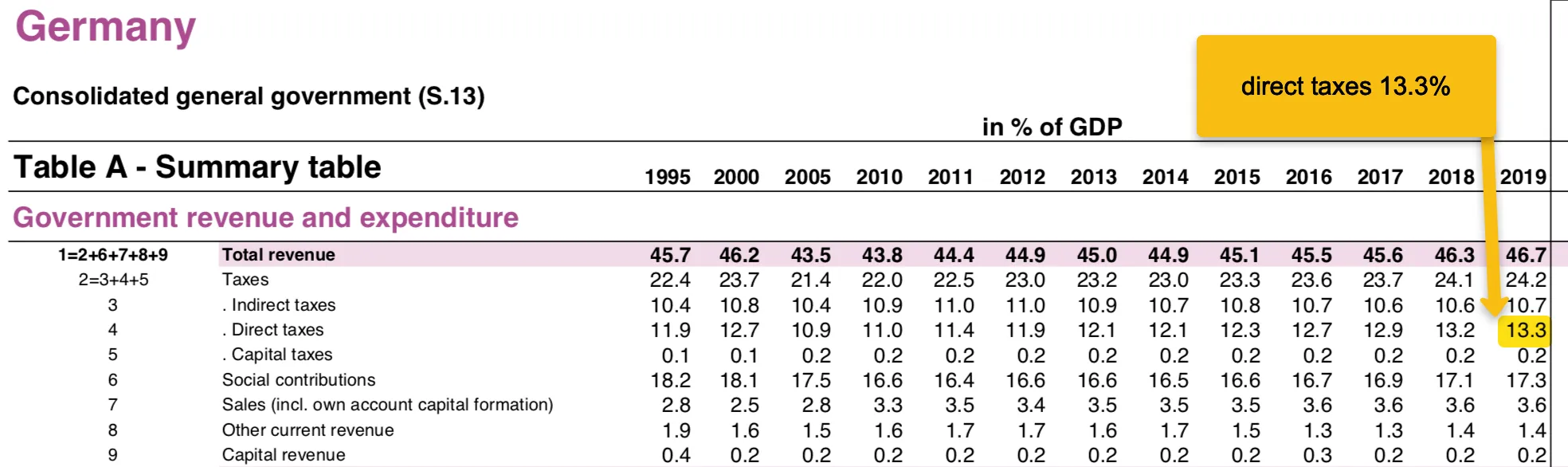

Here are the revenues of Germany as measured by GDP. Germany generated 46.7% in revenue as measured by annual GDP in 2019, so the German treasury filled up with nearly 50% of total GDP.

Quelle: ec.europa.eu

Quelle: ec.europa.eu The influence of politics in Germany and its strict tax policy with hidden and also openly obvious tax increases, accurately reflect the percentage of steadily increasing revenues. Starting from 43.8% in 2010 up to over 46.7% in 2019.

One of the highest rate in the EU: 13.3% direct tax revenue*/GDP 2019

In addition, further on in the article we give legal tips to save taxes in the best possible way.

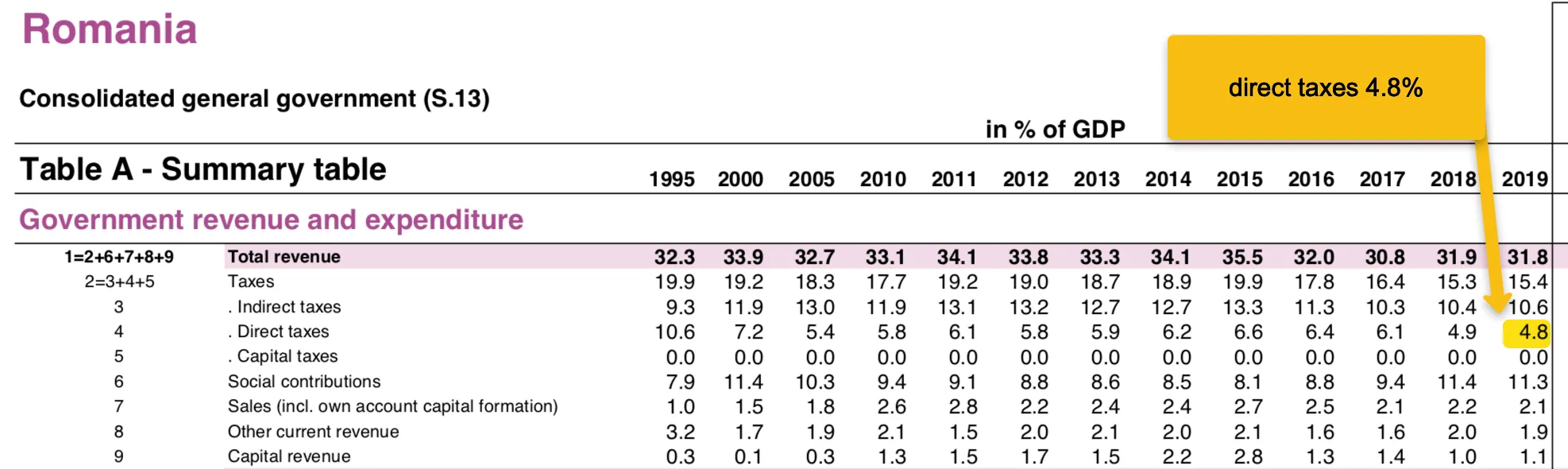

Here are the revenues of Romania as measured by GDP. In simple terms, Romania generated 31.8% in revenue as measured by annual GDP in 2019.

Source: ec.europa.eu

Source: ec.europa.eu Fiscal policy in Romania is lowering taxes year after year to stimulate investment and immigration. Starting from 10.6% direct taxes/GDP in 1995 to 4.8% in 2019.

Lowest value in the EU: 4.8% direct tax revenue*/GDP 2019

*Direct tax revenue: corporation tax, income tax, etc.

Here is an overview of the Romanian tax types:

1. Corporate income tax Romania (Ltd. / SRL)

2. Capital gains tax Romania dividends

3. Profit tax Romania

4. VAT Romania

5. Income tax Romania

6. Wages tax Romania

7. Tax Advice Romania Accounting

8. Company formation in Romania

Update 2023: 10 minutes initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

1. Corporate income tax for companies

Update 2023: 10 minutes initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

Corporation tax, also known as business tax, is calculated as a percentage of a company's profit or turnover. First of all, it should be mentioned that there is no trade tax in Romania. The applicable corporate tax rate for corporations is 16% on profit. A corporation or legal entity in Romania, like the GmbH in Germany, is equivalent to the Romanian legal form of the S.R.L.

There is a special case in Romania: In Germany, on the other hand, limited partnerships (KG) or open commercial companies (OHG) are pure partnerships and are taxed at the personal income tax rate. Different in Romania: The two legal forms S.C.S (KG) and S.N.C. (OHG) are also legally regarded as corporations in Romania and are subject to this taxation.

However, there is one notable exception to the corporate income tax rate of 16% on profits:

1. If the company has a turnover of less than EUR 500,000 per year

a) Can choose whether it wants to be taxed at 16% on the profit

b) Or only pays 1-3% tax on sales

c) 3% tax for no employees companies up to EUR 1.5 million/year

d) 1% tax for one or more employees up to EUR 1.5 million/year

Example: The company "Baumann" will have a turnover of €900,000 in 2022 and generate a profit of €600,000

Question: What taxes have to be paid?

Reply: With at least one employee, a tax burden of 1% on sales of €900,000 is due. There are €9,000 in taxes to pay - and that with a profit of €600,000! (With no employees it is 3% = €27,000 in taxes)

Mistake 1: Mit Wahl der Gewinnsteuer für

Unternehmen in Rumänien von 16% wären 96.000€ an Steuern zu

entrichten.

Mistake 2: With the choice of the profit tax for companies in Germany of 30%, 180,000€ would be payable in taxes.

This only to the taxation on company level - If profit distributions are intended - DE and RO differ again drastically!

Update 2023: 10 minutes initial consultation 100% free of charge.

Inquire now

Call us: +49 89 904 22 360

2. Capital gains tax / Dividend tax in Romania

Update 2023: 10 minutes initial consultation 100% free of charge.

Inquire now

Call us: +49 89 904 22 360

The capital gains tax, also known as the withholding tax, is calculated as a percentage of the profit to be paid out. Dividend tax applies, whether in the case of a profit distribution in the form of a dividend from your own company or dividend payments from listed stock corporations (shares). This is 5% in Romania.

Participations of Romanian companies in other Romanian companies and their payment of dividends among themselves do not trigger any dividend tax and are completely tax-free. The requirement that a minimum 10% stake exist for at least 1 year has been removed. The dividends that a foreign company receives as a result of a participation in a Romanian company are taxed at 5% at source. Mother-daughter companies in Romania can therefore shift profits tax-free.

A distribution of profits for private persons has a 5% dividend tax:

1. If the distribution falls below 27,600 RON (approx. 5,500€) per year:

a) If income tax is no longer due in Romania for private persons

b) In case of exceeding the limit for private persons, residing in Romania 2.760 RON (approx. 500 EUR). Never again!

c) In case of exceeding this limit, private persons

Romania, no additional income tax is due in Romania!

d) If the limit is exceeded, no additional income tax will be charged in Romania for legal entities, no matter where they are based.

Example: The company "Erdmann" will have a turnover of €500,000 in 2022 and generate a profit of €300.00. A profit of €100,000 is now to be paid out to the managing director as a dividend.

Question: What taxes are due on the distribution of profits?

Reply: €100,000 is to be paid out, which means that 5% dividend tax is due. The managing director Mr. Erdmann owns another company in a low-tax country and lives there (for example in Cyprus) and has his profits paid out there. He has €95,000 at his free disposal.

Mistake 1: Do not pay out profits prematurely. A company should mature over 1-3 years before distributing to individuals. Better: make real estate or other investments.

Mistake 2: Profits (withdrawals) can simply be transfered to your own private account in your home country.

Foreign private persons who are not resident or registered in Romania, regardless of their place of residence, are not additionally taxed in Romania with the income tax.

If you invest in a Romanian property instead of paying out a profit and have the rental income transferred to your private account in your home country (e.g. DE, AT, CH) - this income is tax-free in Germany. (Clearly regulated in the DBA DE-RO)

For comparison: In Germany, 26.75% of taxes are levied on profit distributions.

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

3.Profit tax in Romania

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

As the name suggests, a profit tax is a tax on profit. As discussed above, a profit tax of 16% is due for corporations - or a micro-enterprise will opt for up to EUR 1 million in sales/year - then the taxation on sales will be 1-3%. Profit withdrawals (dividends) are taxed at 5%. For further details we ask 1. Corporation tax

and 2. Capital gains tax / dividends To be considered in more detail.

Romania bravely keeps lowering all taxes on profits year after year. Since 2018, income tax has been reduced from 16% to 10%. The turnover amount was increased from €100,000, then €500,000 up to €1.5 million to benefit from the 1% tax. A dividend payment to private individuals was still 15% tax in 2015. A uniform 5% dividend tax has been in force for years.

In order to prevent emigration and promote immigration - further tax reductions are to be expected in the coming years.

Update 2023: 10 minutes initial consultation at 100% free of charge.

Inquire now

Give us a call: +49 89 904 22 360

Update 2023: 10 minutes initial consultation at 100% free of charge.

Inquire now

Give us a call: +49 89 904 22 360

4. VAT Romania

Subject to sales tax, i.e. an obligation to apply for a sales tax ID and the VAT registration is binding for sales of more than 300,000 RON per year. Depending on the exchange rate, this is between 55,000-60,000 EUR. Natural and legal persons who make more than the equivalent of approx. EUR 55,000 in sales per year are obliged to report and pay sales tax. The standard VAT rate in Romania is 19%.

With EU accession, Romania also adopted the so-called reverse charge procedure (reversal of tax liability). If the reverse charge regulation is used, the invoice will be issued without VAT. This rule applies to corporate customers who also have a VAT ID. In the supplier's and customer's books, as well as in the VAT returns, the (actually unpaid) VAT is accounted for as both deductible and collected VAT.

Exports to third countries are exempt from VAT

1. A reduced sales tax rate or exemption from sales tax only applies:

a) Are exempt: Social, medical institutions, education and research

b) The following are exempt: Investment companies, credit and insurance companies

c) 9% sales tax for medicines, groceries and hotels

d) 5% sales tax for culture, cinemas and magazines

Example: The entrepreneur "Rudermann" will make a turnover of €100,000 in 2022 with digital goods and will therefore have no expenses (profit: €100,000). Sales are 50% each from private and corporate customers within the EU.

Question:What sales taxes are due?

Answer: Mr. Rudermann is subject to sales tax and does not pay sales tax on 50% of his sales due to the reverse charge procedure. He owns a second Romanian company that his private customers use to pay their bills. The second company has a turnover (50k) of less than €55,000 and is therefore a small business and exempt from sales tax.

Mistake 1: No splitting of several companies to save sales tax.

Mistake 2: No use of the reverse charge procedure

Almost any number of small businesses with a 55-60k EUR threshold to be exempt from sales tax can be operated. E.g. 5-10 companies at the same time.

Update 2023: 10 minutes initial consultation at 100% free of charge.

Inquire now

Give us a call: +49 89 904 22 360

Update 2023: 10 minutes initial consultation at 100% free of charge.

Inquire now

Give us a call: +49 89 904 22 360

5. Income tax Romania

In general, a flat income tax rate of 10% applies. Romania, including Bulgaria, has the lowest income tax rate in the EU at 10%. However, there are exceptions for even lower tax rates: (e.g. the tax rate for dividends, tax rate for income from the transfer of real estate, etc.)

Exemption from income tax: The Romanian state has classified a few categories of employees as exempt from income tax. These include: IT Specialists – In order to obtain tax exemption, a well-documented process must be followed under strict regulations.

A profit distribution (e.g. from a company) can trigger a small extra tax for private persons in addition to the 5% dividend tax:

1. If the distribution falls below RON 27,600 (approx. €5,500) per year:

a) No more income tax for private persons in Romania.

b) If exceeded, natural persons resident in Romania will have to pay 2,760 RON extra tax. Never again!

c) In case of exceeding this limit, no additional income tax is due in Romania for natural persons. Individuals who are not resident in Romania, regardless of where they live, are no longer subject to additional income tax in Romania.

d) If the limit is exceeded, no additional income tax is due in Romania for corporations, no matter where they are based.

Example: The company "Wassermann" will have a turnover of €400,000 in 2022 and make a profit of €200.00. A profit of €100,000 is now to be paid out to the managing director as a dividend.

Question: What taxes are due on the payout of winnings?

Answer: €100,000 is to be distributed, which means that 5% dividend tax is due. The managing director, Mr. Wassermann, owns an additional company and lives in a low-tax country and has his profits paid out there. He has €95,000 left at his disposal.

Mistake 1: Don't pay out winnings too quickly. A company should mature over 1-3 years before it is distributed to natural persons. Better: make real estate or other investments.

Mistake 2: Simply transfer profits (withdrawals) to your own private account in your home country.

Foreign private persons who are not resident or registered in Romania, regardless of their place of residence, are only charged 5% dividend tax in Romania - which can be offset against the domestic income tax return.

If you invest in a Romanian property instead of paying out a profit and have the rental income transferred to your private account in your home country (e.g. DE, AT, CH) - this income is tax-free in Germany. (Clearly regulated in the DBA DE-RO)

For comparison: In Germany, 26.75% of taxes are levied on profit distributions.

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

6. Income tax Romania

Die Lohnsteuer für Gehälter und Löhne beträgt

10%. Social security contributions and income tax are calculated, withheld and paid by the employer. The total employee share is: 45%. The total employer contribution is: 2.25%

25% Pension insurance employee share, of which 3.75% is accounted for by private old-age provision

4-8 % Pension insurance for special employment conditions Employer's contribution

10% health insurance contribution of the employee's monthly gross income.

2,25% Unemployment insurance contribution of the employer's monthly gross income.

RON 2,300 gross = RON 1,386 net (45% employee share = 25% pension insurance, 10% health insurance, 10% income tax)

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

7. Tax advice in Romania

For many years in Romania, we have created an expert network with the best tax consultants and accounting experts. The expertise goes beyond ordinary bookkeeping and accounting. They have knowledge of tax regulations at national and international level and their tax law.

- Tax advice in Romania

- Tax advice related to various double taxation agreements

- Many years of knowledge of international and national tax law

- Development of tax strategies instead of standardized accounting

- Direct contacts for all tax questions

- No rotation of different employees

From experience: Choose an expert tax consultant compared to a large tax office - where higher costs are incurred and you are just a number. We'll help you with that. Just talk to us!

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Give us a call: +49 89 904 22 360

8. Company formation in Romania

Establishing a company in Romania is particularly worthwhile for medium-sized companies. Taxation falls on sales up to EUR 1.5 million per year - and only at 1%. Romania is considered one of the most liberal small business regulations in the EU. The upper limit is EUR 55,000-60,000 per year, in Germany EUR 22,500 - in order to be exempt from sales tax. Achieve sales of almost EUR 5,000 per month and this is VAT-free. It is quite legal to set up several small businesses in order to save further sales tax.

- Lowest taxes in the entire EU

- Avoidance of double taxation based on double taxation agreements

- Low-wage sector with well-trained staff in certain areas (e.g. IT)

- Managing director and shareholder not visible from the outside (anonymous)

- Direct contacts for all tax questions

- Recognition of the EU company by the local tax office

Do you want to set up a company in Romania? Request advice or call directly! Our expertise specializing in Romania, including our expert network, will help you in almost all matters.

Update 2023: 10 minute initial consultation 100% free.

Inquire now

Ralf Kneissler

Published on 27 September, 2021 / Answer

Just what I was looking for! Very detailed and understandable.

Jonas

Published on September 27th, 2021 / Answer

60,000 EURO/year VAT-free. Almost 5k monthly. You write that several small businesses can be founded, i.e. each company is then exempt with 60k VAT, right?

Kareem

Published on February 14, 2022 / Answer

The income tax of 10% only applies to natural persons residing in Romania? Have I understood that correctly?

Daniel Maier

Published on February 14, 2022 / Answer

Exactly! For people who are not resident in Romania or in DE, AT or CH are not subject to 10% income tax - since the operation of a Romanian corporation (SRL) only involves capital gains tax of 1% or 3% (up to €1.5 million annual turnover), as well as 5% dividend tax on profit withdrawals.

Theo L.

Published on 01 November, 2022 / Answer

The few percent of taxes is nothing. Should it really stay like this? Does the EU play along in the long term?

Daniel Maier

Published on 02 November, 2022 / Answer

Hello Theo, thank you for your message. Romania still has a huge problem with outflow of staff and little immigration of companies and investments. Economic growth is one of the highest in the EU. The tax rates are the lowest in the EU - that's true - it should stay that way for a long time. Since 2018, we have even been able to count on more and more tax breaks. Before 2018, the 1% tax only applied up to €500,000 per year and a 20% share of management and consulting income. This rule has been abolished. In 2022, €1.5 million applies and no restriction on income origin.

Post a comment