E-Mail: info(at)go-eu.com

Tel: +49 (0)89 904 22 360

Update 2023: 10 minutes initial consultation 100% free.

Inquire now

Top 5 tips: Save taxes

In this video I will show you the top 5 examples on how you can save taxes as a company or as a self-employed person in Romania compared to Germany.

1. Reduce personnel costs

Personnel costs are the largest cost factor for most companies. If you manage to reduce this significantly, you can increase your profit and thus your return increase significantly.

In Germany, personnel costs are very high, especially in sought-after specialist areas such as IT, marketing or engineering. But even in other areas, personnel costs can hardly be reduced in Germany due to regulations such as the minimum wage.

In general, the average salary in Germany is €2,860 gross per month.

It is completely different in Romania. The average wage here is just around €600 a month. This means that wage costs in Romania are also significantly lower than in Germany, and you also get a very good job for it. Romania accommodates disproportionately well, especially in the IT and engineering sector trained staff.

2. Trade Tax

In Germany, the trade tax is based on the legal form of the company and on the level of the assessment rate of the municipality. The trade tax in Germany is most influenced by the assessment rate of the municipality. In larger cities, which are also the most attractive for start-ups the assessment rate is often over 400%. But even in smaller municipalities this rate is never below 200%.

It's completely different in Romania! In Romania there is simply no trade tax at all. Nothing needs to be calculated or paid here. No matter in which municipality the company is located in Romania, the trade tax is always 0€!

3. Corporate income tax

In Germany, all legal entities, i.e. a GmbH, GmbH & Co.KG, a UG or a stock corporation have to pay corporate income tax. The federal corporate income tax rate is 15%. And this 15% refers to the the profit of a business year. If a company makes a profit of 100,000€, 15,000€ of this profit is subject to corporation tax. corporate income tax. This is of course in addition to all other taxes, such as the trade tax.

Romania also offers great advantages in terms of corporate income tax! In Romania, corporate income tax is structured in stages:

If you operate your Romanian company and you do not have any employees, the corporate income tax is 3% on the turnover up to 1.5 million Euro turnover per year.

However, if you have one or more employees in your company, the corporation corporate income tax is only 1% on the turnover up to 1.5 million euros per year.

You have to imagine that! Only 1% tax on sales. There are hardly other business models that can keep up. Not even in far away exotic countries...

4. Sales tax (VAT)

Basically, the sales tax is not particularly important, since it is for the Entrepreneurs that only represents a transit item. Sales tax in Germany is generally 19%. Added to this is the so-called small business regulation. This states that if you win up to €17,500 in one year, then no sales tax has to be added on invoices.

In Romania, the sales tax is also 19%. However, there are significant benefits for the small business scheme. Here, the threshold is €70,000 in one year. (RON 300,000)

Within the EU, this corresponds to one of the most liberal small business regulations and thus creates a not inconsiderable competitive advantage - especially for startups and small businesses.

5. Income tax

In Germany, income tax refers to the income of a private person. This means wages and salaries, but also amounts withdrawn from the company, i.e. dividends.

The amount of income tax is based on annual income. Many self-employed end up in one of the highest tax brackets and have to pay tax on their income of up to 45%. In Germany, almost half of the income goes to taxes.

IIn Romania it looks much better!. The income tax here is 10% Flat tax. This means no matter how high the income is, the income tax is always 10%.

If I want to withdraw 80,000€ from my company in Romania to my private account, I have to tax this only with 10%, so that after taxes I still have 72.000€ left. That looks completely different from Germany.

Conclusion

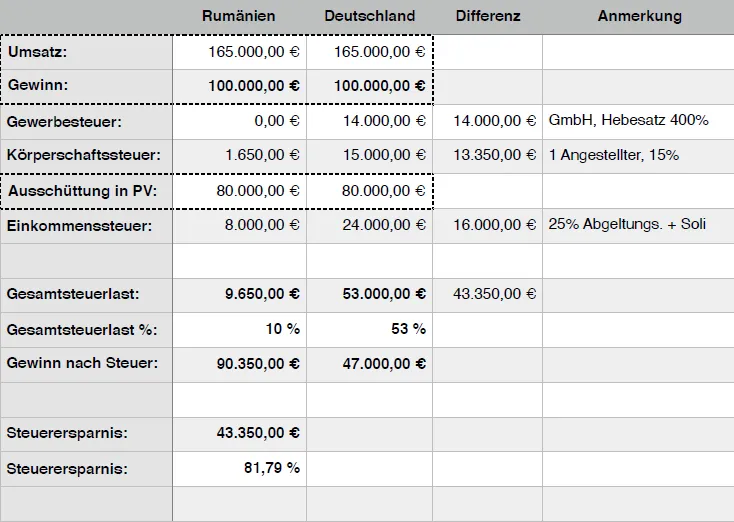

As a conclusion, an overall calculation of the tax burden in Romania and in Germany in comparison with an example!

I hope you enjoyed this blog post - should you be interested in setting up a company or the topic of taxes or real estate in Romania is of interest to you, we would be happy to hear from you. Contact us.

Update 2023: 110 minutes initial consultation 100% free of charge.

Inquire now

Jochen

Published on December 30, 2019 / Answer

Interesting approach to reduce the taxes. Setting up an EU company, in this case in Romania, can make sense. Romania and Bulgaria are also front runners in the EU with the lowest taxes. Small hint: The 70.000€ tax allowance as a small entrepreneur per year is not quite correct. This was perhaps 1-2 years ago times so. 300,000 RON is the tax-free amount - this corresponds to approx. 64,000€. Otherwise great input and great content!

Daniel Maier

Published 02 January, 2020 / Answer

Thanks for your hint! You are absolutely right: it is 300,000 LEI allowance/year for small business/vat free. Depending on the exchange rate, this is a bit under 70k EUR. Good point!

Oliver

Published 14 January, 2020 / Answer

I've been to Romania 3 times myself. I've always liked the country and the people. The tax burden in Germany is frightening, as you can see from the table. The tax office is anyway the whole life your faithful companion, but in the high mass...wtf:) Romania is a real option. I'll keep that in mind!

Georg Lafer

Published 27 October, 2022 / Answer

The tax savings are huge. Whatever profit I have left in Germany in 30 years, I can achieve in Romania in less than 10 years. So for more than 20 years of my life I only work for the German state! Perverse - but anyone who says otherwise is ignorant.

Leave a comment