email: info(at)go-eu.com

phone: +49 (0)89 90 42 23 60

assisted in a company setup.

Table of contents:

- What Is an EOOD in Bulgaria?

- Why choose an EOOD?

- For who is an EOOD Best For?

- Taxes EOOD

- Accounting EOOD

- VAT Bulgaria

- Common Mistakes

- EOOD vs Other Bulgarian Companies

- EOOD and OOD difference?

- Before Opening an EOOD

- Final Thoughts

- Related Guides

Understanding what an EOOD really is and for whom it is best

08 january 2026 3378 4What Is an EOOD in Bulgaria?

An EOOD (Ednolichno Druzhestvo s Ogranichena Otgovornost) is the Bulgarian equivalent of a single-member limited liability company. It is similar to a single-owner LLC in other EU countries.

Key characteristics of an EOOD:

- One shareholder (individual or legal entity)

- Separate legal personality

- Limited liability (your personal assets are protected)

Because of its simplicity and flexibility, the EOOD is the most popular company structure in Bulgaria for foreign founders.

We answer all your questions about an EOOD in Bulgaria – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Why Entrepreneurs Choose an EOOD in Bulgaria

1) One of the Lowest Tax Systems in Europe

Bulgaria consistently ranks among the countries with the lowest taxes in Europe, making it especially attractive for international entrepreneurs. You can see how Bulgaria compares across the EU in this overview: Lowest taxes in Europe – Top 10 countries.

The core tax advantages of an EOOD include:

- 10% corporate income tax

- 5% dividend tax

- 10% flat personal income tax

This simple and transparent tax system is a key reason Bulgaria stands out compared to many other EU jurisdictions.

2) No Requirement to Be a Bulgarian Resident

One common misconception is that you must live in Bulgaria to open or run an EOOD. In reality:

- You do not need to be a Bulgarian resident

- You do not need Bulgarian citizenship

- You can manage the company remotely

This makes the EOOD ideal for digital entrepreneurs, consultants, agency owners, and international service providers. For the company formation process, see: How to open a company in Bulgaria.

3) Minimal Share Capital and Simple Setup

Opening an EOOD is surprisingly accessible:

- Minimum share capital: 2 BGN (≈ 1 EUR)

- Fast registration process

- Clear legal framework

Compared to many Western European countries, administrative complexity and startup costs can be significantly lower.

Who Is an EOOD in Bulgaria Best For?

An EOOD is particularly suitable if you are:

- A freelancer or consultant

- An online business owner

- A service-based entrepreneur

- An international founder looking for EU access

- A business owner seeking tax efficiency with stability

Foreign entrepreneurs can find a detailed breakdown here: Starting a business in Bulgaria as a foreigner.

Taxes for an EOOD in Bulgaria (Overview)

Understanding taxes is critical before opening an EOOD. Bulgaria’s system is simple, but mistakes can still be costly.

Corporate Tax

- Flat 10% corporate income tax

- Applied to net profits after allowable expenses

Dividend Tax

- 5% withholding tax on distributed profits

- Often lower than in most EU countries

Personal Income Tax

- 10% flat rate if you pay yourself a salary

Accounting Obligations for an EOOD

While Bulgaria’s tax rates are low, compliance and accounting must be handled correctly. This is where many foreign founders underestimate the importance of professional support.

An EOOD must typically:

- Maintain proper bookkeeping

- File VAT returns (if registered)

- Submit annual financial statements

- Comply with Bulgarian accounting standards

Choosing the right accountant is not optional, it is a strategic decision. Learn what to look for here: Bulgaria accounting services.

VAT and an EOOD in Bulgaria

An EOOD may be required to register for VAT depending on activity and thresholds, for example if:

- Annual turnover exceeds the VAT threshold

- You provide cross-border EU services

- You trade goods within the EU

VAT handling is one of the most common areas where things go wrong, especially for international businesses. Incorrect VAT registration or reporting can quickly eliminate the tax advantages Bulgaria offers.

Common Mistakes When Opening an EOOD in Bulgaria

1) Focusing Only on Low Taxes

Low tax rates alone do not guarantee low total taxation. Structure, profit distribution, and personal tax residency all matter.

2) Choosing the Cheapest Accountant

Low-cost accounting services often provide basic bookkeeping but no tax planning. This can result in:

- Overpaying taxes

- Compliance risks

- Missed optimization opportunities

3) Mixing Personal and Company Finances

An EOOD is a separate legal entity. Improper expense handling or undocumented withdrawals can lead to tax issues.

4) Ignoring Long-Term Planning

Decisions made in the first year often have consequences for years to come. Residency options, dividend strategies, and company growth should be planned early.

We answer all your questions about an EOOD in Bulgaria – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

EOOD vs Other Bulgarian Company Types

While other structures exist (such as OOD or sole trader forms), the EOOD remains the most flexible option for many foreign founders because:

- It offers limited liability

- It allows full control by one owner

- It integrates well into international structures

For most non-resident founders, an EOOD is the default and most efficient choice.

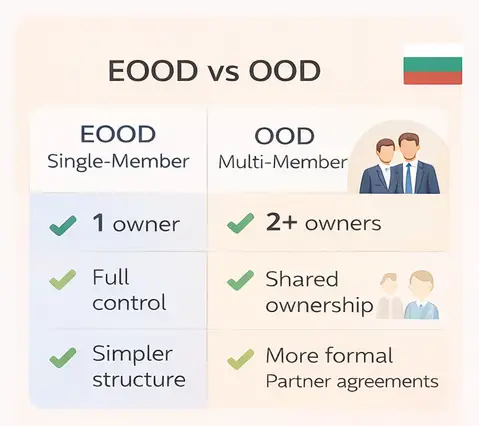

EOOD vs OOD in Bulgaria: What’s the Difference?

When opening a company in Bulgaria, most entrepreneurs choose between two structures:

EOOD – Single-Member Limited Liability Company

OOD – Multi-Member Limited Liability Company

Both are popular, flexible, and tax-efficient. The key difference lies in ownership structure, not taxation.

Basic Definition

EOOD (Ednolichno Druzhestvo s Ogranichena Otgovornost)

- One shareholder only (individual or legal entity)

- Full control by a single owner

- Most common choice for freelancers, consultants, and solo founders

OOD (Druzhestvo s Ogranichena Otgovornost)

- Two or more shareholders

- Ownership divided into shares

- Suitable for partners, co-founders, or investors

The difference between EOOD and OOD in Bulgaria lies mainly in the ownership structure, not in taxation or legal protection. An EOOD is a single-member limited liability company with one owner who has full control over all decisions, while an OOD has two or more shareholders who share ownership and decision-making. Both company types provide limited liability, meaning the owners’ personal assets are protected. From a tax perspective, EOOD and OOD are treated identically, with the same 10% corporate tax and 5% dividend tax. The minimum share capital requirement is the same for both and is purely symbolic. In practice, an EOOD is simpler to manage and administrate, as it does not require shareholder meetings or joint resolutions. An OOD, on the other hand, is more suitable when partners or investors are involved, as ownership shares and governance rules must be clearly defined. Many entrepreneurs start with an EOOD and later convert it into an OOD once additional shareholders join the business.

Practical Steps Before Opening an EOOD

Before you proceed, make sure you:

- Clarify your tax residency situation

- Define how profits will be distributed

- Choose professional accounting support

- Understand VAT implications

- Plan for the long term, not just the first year

These steps help ensure that your EOOD delivers real value not just low headline tax rates.

Final Thoughts: Is an EOOD in Bulgaria Worth It?

For many entrepreneurs, the answer is yes, but not automatically.

An EOOD in Bulgaria combines:

- One of the lowest tax systems in the EU

- EU market access

- Simple legal structure

- Flexibility for non-residents

However, success depends on how the company is structured and managed, not just where it is registered.

If you approach an EOOD with proper planning, professional accounting, and a clear understanding of Bulgarian tax rules, it can be a powerful and sustainable business solution.

We answer all your questions about an EOOD in Bulgaria – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Winfred

Published on 29 December, 2025 / Answer

Now I finally understand the difference between an EOOD and an OOD.

Urs

Published on 29 December, 2025 / Answer

Bulgaria is the way to go. I want to live in Varna and everyday beach life and low tax. Can it get better?

ludo

Published on 30 December, 2025 / Answer

Burgas is more active in the winter. For full year around I can recommend it, Sofia is also not far

Thomas Hofmann

Published on 30 December, 2025 / Answer

We have offices in Bulgaria, and company incorporations can be completed entirely remotely. We look forward to hearing from you.

Leave a comment